Tue, Jul 30, 2019

Art was one of the top-performing asset classes in the latest Knight Frank Luxury Investment Index (KFLII) with the value of the Art Market Research World Index rising by 12% over the past 12 months.

However, rare whisky continues to lead the KFLII by some margin at the end of Q1, 2019. No other asset class comes close to the 12-month (35%) or ten-year (563%) growth of the Knight Frank Rare Whisky Index despite the value of whisky falling slightly in the first three months of the year due to oversupply in the market.

Growth at the top end of the classic car market, as tracked by HAGI, dropped after a period of very strong growth. However, high value sales are nevertheless still taking place.

Wine is in a period of uncertainty with value rising 6% in the 12 months to Q1 2019. On the one hand, the drop in the sterling makes the large wine reserves held in the UK cheaper to overseas buyers but on the other hand, the biggest export market, China is responding to tariff uncertainty with reduced levels of spend.

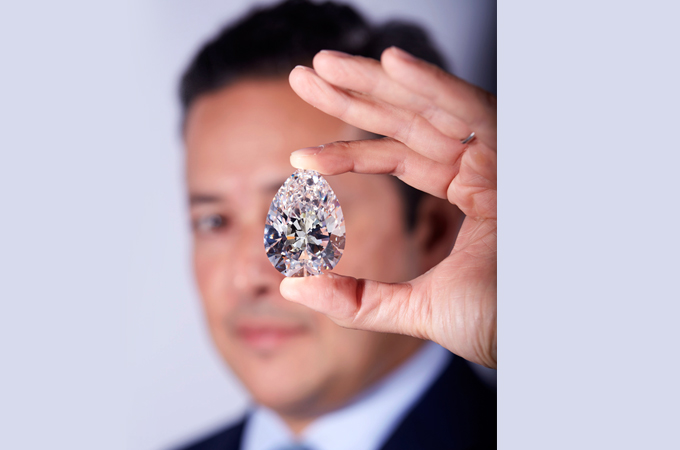

Although jewellery looks to have had a tough 12 months, the overall figure hides a more nuanced story. While pearl jewellery indeed fall back in value by 13% over the past year - after a decade of very strong growth - other sectors of the market performed much better. Belle Epoque and Art Deco jewellery, for example, saw 9% growth, while post-war jewellery was up 7%.

Andrew Shirley, head of luxury research at Knight Frank, commented: “In this issue of our Luxury Investment Index, we take an in-depth look at the performance of coloured gemstones. The interesting story here is that coloured gemstones are outperforming the wider jewellery market with some significant sales taking place already in 2019.”

At Bonhams’ London sale at the end of April 2019, several coloured gemstone lots blew away their estimates. The top performer was a 17.43-carat Kashmir sapphire ring, formerly owned by a European noble family that fetched £723,063, far exceeding its £300,000 to £400,000 guide price. The second highest performing lot was a diamond and sapphire transformable necklace by Spanish jeweller, Grassy. Dated to around 1935 and featuring a 34.59-carat Sri Lankan (no heat) sapphire, the necklace sold for £287,562 against its pre-sale estimate of £120,000 to £180,000.

Record prices per carat for rubies have been achieved with prices rising to US$1.2m in 2016, a threefold growth between 2006 and 2016.

Sean Gilbertson, CEO of Gemfields, commented, “The swing towards precious coloured gemstones is overwhelming. The past decade has seen the world record prices for an emerald and ruby surpass that of a colourless diamond on a per carat basis. It surely can’t be long before sapphires overtake diamonds, too.

“We expect vibrant consumer interest and sector growth to continue. Responsible sourcing will receive ever-increasing attention and become progressively more important to consumers, making gemstone provenance perhaps the key driving factor.”

.jpg)